cryptocurrency tax calculator canada

Koinly calculates your crypto taxes and helps you reduce your tax bill no matter if you need to report business income or a capital. The first step in calculating cryptocurrency tax in Canada is to figure out how much you earned.

Crypto Tax A Glimpse Into Canada S Taxation Laws On Cryptocurrencies Bitcoinke

To work cryptocurrencies rely on a sort of.

. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software. Our platform allows you to import transactions from more than 450 exchanges and. Cryptocurrency Tax Calculator.

Coinpanda is a cryptocurrency tax calculator built to simplify and automate the process of calculating your taxes and filing your tax reports. Integrates major exchanges wallets chains. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations.

Koinly is one of Canadas most popular crypto tax calculators. Coinpanda is one of. To do this determine the value of each cryptocurrency at the time that it was.

Use Crypto Tax Calculator. To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or loss and compare your tax outcome of a short term versus long term. However it is important to note that only 50 of your capital gains are taxable.

The Senate reviewed the issue of. Straightforward UI which you get your crypto taxes done in seconds at no. The source data comes from a set of trade logs which are provided by the exchanges.

Establishing whether or not your transactions are. Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made. A tool to calculate the capital gains of cryptocurrency assets for Canadian taxes.

Bitcoin Tax Calculator for Canada Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance Schedule 3 Form Adjusted Cost Basis Superficial Loss. Cryptocurrency is a type of digital currency or payment that may be used to buy and sell goods and services on various online platforms. Covers NFTs DeFi DEX trading.

The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. IRS Form 8949 TurboTax Support.

You can export all the required forms in under. Thats why most people use a cryptocurrency tax calculator like Coinpanda to handle this and generate all required tax reports and forms automatically.

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

How To Calculate Your Crypto Tax In Canada

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

Calculate Your Crypto Taxes Using The Formulae Below Or Simply Use My Automated Software Hackernoon

Bitcoin Taxes Bitcointax Twitter

Koinly Review Our Thoughts Pros Cons 2022

Cryptocurrency Tax Calculator Forbes Advisor

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds

11 Best Crypto Tax Calculators To Check Out

Crypto Taxes In Canada Adjusted Cost Base Explained

Canada Crypto Tax The Ultimate 2022 Guide Koinly

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto

Best Crypto Tax Software Top Solutions For 2022

11 Best Crypto Tax Calculators To Check Out

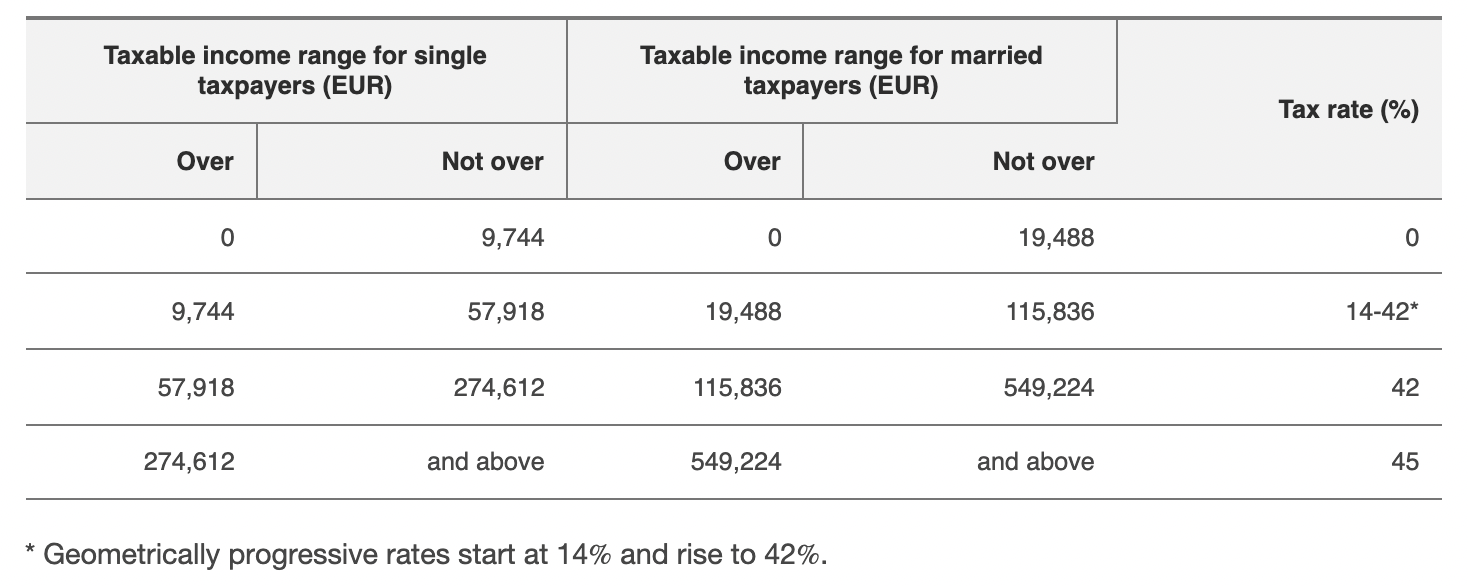

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Free Crypto Tax Calculator Coinledger

How To File Taxes On Your Cryptocurrency Trades In A Bear Year Techcrunch